Between the 14th and 16th of July, a conference took place in Washington DC that seemed to have largely slipped under the radar. Titled the “National Conservatism conference”, it was organized and funded primarily by the Edmund Burke Foundation—a conservative philanthropy that, while based in the Netherlands (in the Hague, to be more specific), boasts ties to the better-known litany of neoliberal think-tanks such as the Heritage Foundation and the American Enterprise Institute (AEI) It’s an indication of a shifting economic climate: both Heritage and the AEI (the latter of which responded critically to much of the conference) have been longtime promoters of what has been called the “Washington Consensus”, which takes a deregulatory approach, coupled to managed globalization via free trade agreements and an agenda of privatization, as the optimal baseline for economic growth. The conference, by contrast, was a debate over the merits of the economic nationalism that has taken root in various forms around the group, typified in the United States by the Trump administration’s skepticism of free trade and the willingness to amplify the use of protectionist measures that had previously taken a back seat, only to be wheeled out in exceptional circumstances.

This sense of economic nationalism appears as the the right-wing counterpart to the critique of neoliberalism that has been the calling card of the populist and social democratic left—but in place of their litany of intellectuals and advocates, the conference’s roster of economic nationalists offers a counter-lineage, one that includes Fox New’s chief right-populist pundit Tucker Carlson and venture capitalist Peter Thiel. Thiel himself gave the keynote address to inagurate the conference’s opening, which he titled “The Star Trek Computer is Not Enough”.

According to a summary of the talk posted on Medium (the talks themselves have yet to have been made public, assuming they will be at all), Thiel reiterated his well-known concerns over the efficacy of so-called ‘post-industrial’ growth:

Google is building the Star Trek computer. It knows everything and can answer all of your questions. It’s organizing the world’s information.

But now let’s ask the question on the level of the U.S.: Are people’s living standards improving? Silicon Valley says yes, but their story is at odds with what people are experiencing on the ground.

There’s been a lot of innovation in the world of bits and software, but not in atoms — real, hard engineering problems. If you had been in college a few decades ago, it would have been a bad career move to go into engineering at Stanford. Instead, there has been a narrow cone of progress around bits (software). (Note: This has been a consistent point in Thiel’s talks.)

Maybe we’ve built the Star Trek computer, but we don’t have anything else from the Star Trek universe. We’ve had a few decades of relative stagnation. The younger generation is now finding it a struggle to live up to the living standards of Baby Boomers.

It’s worth looking deeper at Thiel’s claims. The prevailing economic context indeed looks grim. Despite the rapid introduction of new technologies and the excited rhetoric of paradigm-shattering shifts in the make-up of the contemporary American techno-industrial super-structure, there’s been a marked slowdown in productivity since at least 2004. Wage stagnation has been a long-running reality. Even prior the America-China trade war, global trade has been experiencing a decline, as has business investment spending, despite there being a literal superabundance of capital at the global level. For well-over a year, the Bank for International Settlements has issued warnings that raise the specter of a looming recession, noting the existence of a global ‘debt trap’ and the accelerating decreasing returns in the strategy of quantitative easing pursued by worldwide central banks following the Great Recession. Flipping to a Marxist perspective, the rate of profit appears to be moribund, which Marxist economists like Michael Roberts have linked to the deceleration in investment spending.

Other leftist and Marxist thinkers and economists have pointed to a period of stagnation much lengthier than the years clustered around the Recession: the aforementioned Roberts, Yanis Varoufakis, Wolfgang Streeck, Michael Hudson, Robert Brenner, Robert Kurz and others have pointed to the emergence of a terminal conditions in the early 1970s, thus wrapping stagnation into the whole of the so-called globalizing era and the ascendancy of finance capital (I also argued this in Uncertain Futures, using both the Marxist rate of profit and the ‘techno-economic paradigm’ model of Perez and Freeman). Thiel, along with fellow arch-stagnationist Tyler Cowen, shares this frame of time with the left. For Cowen, stagnation arises in the situation in which the ‘low-hanging fruit’—that is, innovations capable of producing high returns— have been ‘picked’ (for a critical take, even anti-stagnationist take on Cowen’s argument, check out Kevin Carson’s analysis).

Thiel’s position is similar to Cowen’s, with several key differences. Like Cowen, he sees the phenomenon of decreasing returns, particularly where information technology is concerned, as an actuality—though this is not first and foremost the reason for stagnation. The replacement of innovations that drive high rates of growth with those that promote low-growth corresponds with the decline of a government willing to underwrite the costs in the promotion of innovation itself. It’s a distinct break with the sort of libertarian orthodoxy that one might expect Thiel to be inclined towards. To quote his 2011 essay “The End of the Future”:

The most common name for a misplaced emphasis on macroeconomic policy is “Keynesianism.” Despite his brilliance, John Maynard Keynes was always a bit of a fraud, and there is always a bit of clever trickery in massive fiscal stimulus and the related printing of paper money. But we must acknowledge that this fraud strangely seemed to work for many decades. (The great scientific and technological tailwind of the 20th century powered many economically delusional ideas.) Even during the Great Depression of the 1930s, innovation expanded new and emerging fields as divergent as radio, movies, aeronautics, household appliances, polymer chemistry, and secondary oil recovery. In spite of their many mistakes, the New Dealers pushed technological innovation very hard.

The New Deal deficits, however misguided, were easily repaid by the growth of subsequent decades. During the Great Recession of the 2010s, by contrast, our policy leaders narrowly debate fiscal and monetary questions with much greater erudition, but have adopted a cargo-cult mentality with respect to the question of future innovation. As the years pass and the cargo fails to arrive, we eventually may doubt whether it will ever return. The age of monetary bubbles naturally ends in real austerity.

In his book Zero to One (undoubtedly the downright oddest selection in the vast, dull library of business lit), the gulf between Thiel and the libertarians is even more pronounced. Drawing somewhat covertly on the works of Rene Girard, he contrasts “horizontal or extensive progress”, in which progress proceeds through memetic imitation, and “vertical or intensive progress”, described as “doing new things”. Here’s a rather simple image he provides to illustrate this in Zero to One:

“At the macro-level”, he writes, “the single word for horizontal progress is globalization—taking things that work somewhere and making them work elsewhere”. Horizontal progress, in other words, corresponds to the unbridled expansion of the market—with the implication that the market ultimately diverges from the production of new innovations. It’s a bracing inversion of the conclusions drawn by the left-libertarians (and the right-libertarians, when they’re being honest) from the classical Braudelian distinction between markets and capitalism, in which capitalism—as a top-down concentration of power that sets prices—is presented as an anti-market system, with markets (or ‘micro-capitalisms’) behind a bottom-up series of fluid organizations that take prices. Against those who would side with the market against capitalism, Thiel, when read from the Braudelian framing, seems to affirm capitalism against the market. But there’s also an interesting, albeit warped, symmetry with Marx’s analysis: for Marx, capitalism unfolds and reproduces itself through the unity of the sphere of production and the sphere of circulation, but it is the sphere of production—which undergoes intensive transformation in accordance with the intensification of productivity—which is primary. The sphere of circulation, manifesting as the world market, undergoes extensive growth in accordance with this intensive transformation.

The intensive production of the new, for Thiel, is of course technology. Hence:

Thiel thus argues that dual subordination of ‘economic progress’ to the mimetic flows of the globalizing market and ‘technological progress’ to the computer is the machine that produces stagnation. “We wanted flying cars, instead we got 140 characters”.

This drive, to turn from supposed market-led innovation to the intensive technological progression, brings us back to the National Conservatism conference. From one direction, economic nationalism’s skepticism toward globalization and willingness to pursue protectionism appears as the cousin to Thiel’s critique of the horizontalist market. From another direction, however, it remains in a secondary position to his primary concern, which is a state willing to play an active role in development. It’s interesting, then, to note that a debate between Oren Cass (former policy director for the Mitt Romney campaign and a senior fellow at the Manhattan Institute for Policy Research) and Richard Reinsch (a fellow at the libertarian Liberty Fund) took place over the topic of industrial policy. The outcome?

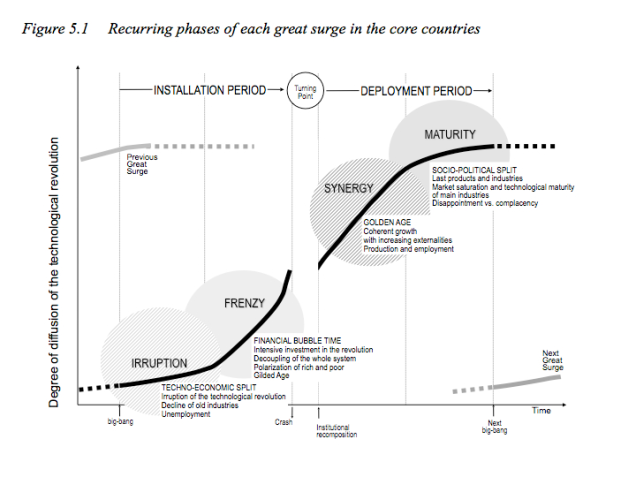

Let’s switch gears a bit and look to Perez’s model of techno-economic paradigms, which is itself an updating of Soviet economist Nikolai Kondratiev’s theory of ‘long waves’ of economic development. Without going down the rabbit hole too deeply, a brief summary is in order. For Perez, techno-economic paradigms constitute the rhythm of capitalist development, which unfolding through cycles organized by ‘lead technologies’ whose introductions are capable of obliterating past forms of organization, class composition and governance, and therefore call into being new forms appropriate to the demands of that cycle. Each paradigm is split into two primary phases: the installation phase, in which the new lead technology and the cluster of correlated technological objects and systems are rolled-out, clashing with the legacy of the old, attracting investment, setting off bubble growth, etc. The second phase is the deployment phase, the ‘Golden Age’ of the paradigm in which all forms of organization are reset, growth and investment rates stabilize, and eventually begin to stagnate, priming conditions for the new installation phase to come.

The seperation of the installation and deployment phases are punctuated by a turning point, which manifests as a crisis (usually, in Perez’s work, driven by the bubble that inevitability grows in the installation phase, through from a Marxist perspective I have serious quibbles with situating this as primary). The crisis annihilates old capital, clears malinvestment, and sets the condition for the institutional recomposition that underwrites the golden age. All in all, the totality of a given rhythmic cycle looks something like this:

Leaving aside the question of the possibility of a long-range stagnationist trend since the 1970s, we can perhaps position the Recession as the turning-point crisis in the current wave. This shakes apart a sizeable portion of Thiel’s position, by recontextualizing the interdeterminacy of his model into the motion of capitalist development: it’s by no coincidence that he points backwards the New Deal and its role in prompting innovation and growth, because the New Deal was the indicator of the institutional recomposition that occurred following the Great Depression, which was the turning point-crisis of the previous wave of growth. Fast forward to the aftermath of the Great Recession, and nothing of the sort occurred. In the midst of the crisis, a handful of President Obama’s advisors urged him to embark on a massive program akin to a New Deal, but the policy solutions that went forward—those that emerged a prominent faction of advisors picked from the ranks of the laughably-named Hamilton Project, a finance capital-aligned policy initiative at the Brookings Institute and launched by veterans of President Clinton’s economic team—moved against this.

While dashed to pieces on the reef of centrist policy, echoes of this agenda have haunted the fringes (fringes which, incidentally, have become something of a counter-mainstream as the years wear on) of the Democratic Party. The now-much derided Green New Deal, which emerged first around 2006, became a central spoke in the policy agenda presidential hopeful Jill Stein in 2012 and 2016, while Bernie Sanders adopted elements of it—alongside calls for a more generalized, yet comprehensive, program for economic redevelopment and infrastructure revitalization—in both his 2016 and current-day election campaigns. A veritable Green New Deal wing of the Democrats emerged in 2018, after Alexandria Ocasio-Cortez and Ed Markey unveiled a rather oblique policy proposal. Assaulted by both the Republican Party and the mainstream of the Democrats, the Green New Deal proposition appears dead in the water, legislatively speaking, though it has been partially taken up by environmental movements such as Extinction Rebellion.

Besides the Green New Deal, we could also look at the proposals put forward by Andrew Yang. There is, of course, the “Freedom Dividend”, a universal basic income of $1000 for each US citizen over the age of eighteen (to be financed, embarrassingly, by a value-added tax). More interesting, however, are his proposals to reposition government as a driver of innovation, with massive subsidies for medical research, the re-creation of the Office of Technological Assessment, and a large-scale public works program for infrastructure. Most interesting—and bizarre—is his rather Promethean proposal for a “Legion of Builders and Destroyers”:

Rechannel 10% of the military budget – approximately $60 billion per year – to a new domestic infrastructure force called the Legion of Builders and Destroyers. The Legion would be tasked with keeping our country strong by making sure our bridges, roads, power grid, levies, dams, and infrastructure are up-to-date, sound and secure. It would also be able to clear derelict buildings and structures that cause urban blight in many of our communities and respond to natural disasters. The Legion would prioritize projects based on national security, economic impact, and regional equity. Its independent budget would ensure that our infrastructure would be constantly upgraded regardless of the political climate. The Commander of the Legion would have the ability to overrule local regulations and ordinances to ensure that projects are started and completed promptly and effectively.

From the left to the right, the increasing call for industrial policies, public banks, infrastructure development, government-assisted innovation, New Deals, etc, are all responses to the growing recognition of the necessity for an institutional recomposition. If the National Conservatism conference can be treated as a measure (not to mention Trump’s own economic nationalism), the agenda appears to be advancing relatively smoothly in the ranks of the right. On the left, however, the various propositions have failed to congeal into a coherent tendency, and as of now remain scattered in the wind. This is in no doubt at least partially due to the rear-guard attack that the mainstream of the Democratic Party has been carrying out, choosing to pursue the disruption of Trump via the chase of conspiracy theories, all the while conceeding crucial ground. It’s thus an ironic situation: it has repeatedly failed to address the underlying crisis, even in the limited capacity it can (limited because the Democratic Party, like its Republican counterpart, is a party of the bourgeoisie), even though this crisis is a primary cause of right-populism that it so detests.

Thiel’s getting a lot of press this week for providing the data/tracking for the ICE raids, there is a bit of lefty economic nationalism that pace Thiel are anti-monopoly open marketers led by folks like @matthewstoller

ps some lecture materials from a seminar on CRRU and their aftermath for yer twitter peeps:

https://app.box.com/s/vl8wqylhla809r4szvrkcsyf1jn0yx8c

LikeLiked by 1 person

Yeh I’ve been following the story quite closely, it’s wild really. Truly drives home the implications of the name ‘Palantir’. Also obliquely raises a key point: while stagnation is quite undeniable and something like an industrial policy is necessary, it is precisely venture capitalists like Thiel who stand to have a vested interest in the sort of explosion that this could generate.

Thanks for the link! I’ve been whittling down a room full of stuff to either throw away or sell and this has been an excellent thing to listen to through the tedium.

LikeLike

sure, yeah take a look at Stoller’s stuff I think you might like him:

https://mattstoller.substack.com/

LikeLiked by 1 person

DMF — who is giving these lectures? Just curious.

LikeLike

It’s @Sal100001 on twitters

LikeLike

Vincent Le @ Deakin U. kindly shared these materials from his course with us.

LikeLike

it’s all taking on a kind of old-school cyberpunk feeling

https://washingtonbabylon.com/podcast/episode-13-barrett-brown-on-palantir-and-ice-raids/

LikeLiked by 1 person

“Metrophage tunes you into the end of the world. Call it Los Angeles. Government is rotted to its core with narco-capital and collapsing messily. Its recession leaves an urban warscape of communication arteries, fortifications, and free-fire zones, policed by a combination of high-intensity LAPD airmobile forces and borderline-Nazi private security organizations.”

LikeLiked by 1 person

free floating anxiety

https://www.abc.net.au/radionational/programs/futuretense/offshore-architecture-and-marine-urban-sprawl/11559722

LikeLike